what credit bureau does oportun use

According to the Federal Reserve Board the average regular APR is 15 for all credit cards and 17 for accounts that carry a balance. Oportuns loan amount range is 300 to 10000 a smaller range than what LendingPoint or Upgrade offer.

Report Vulnerabilities Through Oportun S Hackerone Program Oportun

Debit cards are also accepted.

. They use special data analytics to offer affordable and credit. This card has higher than average regular APRs. So you should really ask yourself if its something you need right now.

LendingPoint has loans between 2000 to 36500 and. This product is mostly recommended by SuperMoney users with a score of 36 equating to 37 on a 5 point rating scale. The Oportun Visa Credit Card interest rate is 249 - 299 V with the actual rate depending on factors such as your income credit history and existing debt.

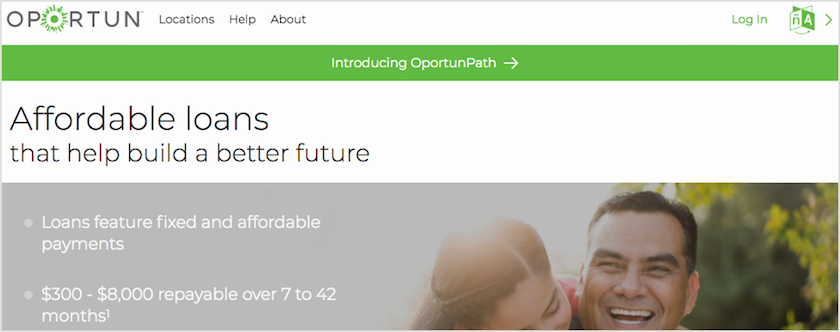

You dont need a credit history Social Security number US. Oportun is a lender that offers unsecured and secured personal loans in 34 states around the country. Oportun reports payments to Experian and TransUnion but not Equifax.

The Oportun Visa Credit Card is an unsecured card and offers starting credit lines of up to 1000. The Oportun Visa Credit Card. It provides its users with access to on demand funds the ability to build.

Thus Oportun a financial company built specifically to service those with little or no credit history was founded in 2005. Automatic payments are the. ID or bank account to qualify.

Reports payments to two credit bureaus. Just log in to your online credit card account and use your checking or savings account to make a one-time or recurring payment. That said they are a BBB-accredited business since 2016 with an A ratingOn BBB they have a customer review score of 255 with 90 complaints closed in the last 3 years.

Yes Oportun is a legit loan company that offers personal loans of 300 - 10000 to people with bad credit or better. The Oportun Visa Credit Card might be a good fit for people with limited or no credit history. Oportun is registered to do business in the states it.

It offers smaller loans between 300 and 20000 targeted toward people. Hey Ane I believe Oportun loans are considered a consumer finance accounts. It can help you in grabbing secured and unsecured personal.

In Personal Loans from Oportun Inc. Most lenders report payments to all three major credit. Here are five things to know about the card.

And since your payment history will be reported to the major credit bureaus. However 2 months later the loan is still showing up on his credit report with Experian and We would like someone to reach out to us and look into this matter. If you are fed up with rejections from mainstream banks then Oportun is the ultimate lending company to you.

Oportun Loans Review Pros Cons Lendedu

Oportun Review 2022 Bad Credit Loans Up To 10k 100 Approval No Credit Check Credit S2 E174 Youtube

How To Refinance A Personal Loan Oportun

Oportun Accelerates Nationwide Expansion

Oportun Announces Definitive Agreement To Acquire Digit

Oportun Personal Loans 2022 Review Nerdwallet

Honest 2022 Oportun Reviews Loan Amount Apr More

Draft Registration Statement Submission No 6

Oportun Personal Loans Review 2021 Dailynationtoday

Oportun Personal Loans 2022 Review Nerdwallet

2022 Oportun Credit Card Reviews

Credit Smarts What S A Credit Score And How Do I Get My Credit Report Oportun

Oportun Crunchbase Company Profile Funding

Oportun Visa Credit Card Review

Laura S Story And How Her Loan Choice Affected Her Life Oportun

Oportun Visa Credit Card Review 2022 Is It Worth The Hype

Oportun Visa Credit Card Review Youtube

New Jersey Residents Can Now Apply For Affordable Oportun Loans Oportun